REPORT ON AN EXPLORATORY DATA ANALYSIS AND DATA VISUALIZATIONS ON LOAN DATASET

About Company

Dream Housing Finance company deals in all home loans. They have presence across all urban, semi urban and rural areas. Customer first apply for home loan after that company validates the customer eligibility for loan.

Problem Statement

Company wants to automate the loan eligibility process (real time) based on customer detail provided while filling online application form. These details are Gender, Marital Status, Education, Number of Dependents, Income, Loan Amount, Credit History and others. To automate this process, they have given a problem to identify the customers segments, those are eligible for loan amount so that they can specifically target these customers. Here they have provided a partial data set. HERE is the dataset

The visualizations below shows the relationship between the various features and and the target feature [Loan Status] that can determine those are eligible for loan

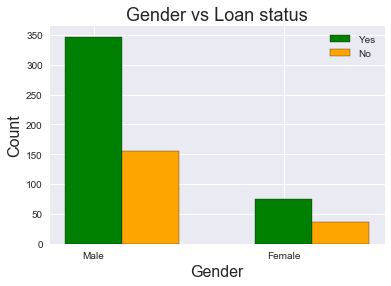

Relationship between Gender and Loan Status

The chart above shows that the we have more married than single customer approved for loan

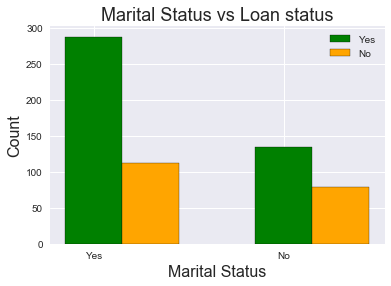

Relationship between marital status vs loan status

From the chart, we can see that the number of dependents may automatically affect the approvals of home loans. There is a higher chance of getting home loan approval for applicants who have less number of dependents or no dependents.

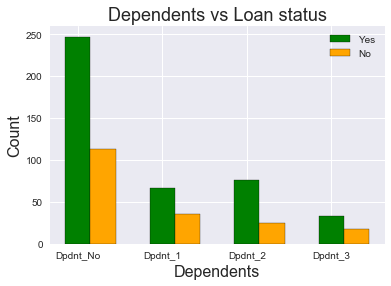

Relationship between Dependents vs Loan status

From the chart, we can see that the number of dependents may automatically affect the approvals of home loans. There is a higher chance of getting home loan approval for applicants who have less number of dependents or no dependents

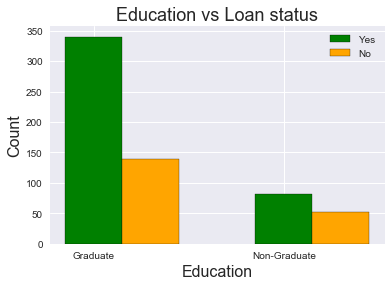

Relationship between education vs Loan status

From the chart above, we can conclude that the applicants who are graduate were in higher percentage of loan approval than non-graduate applicants.

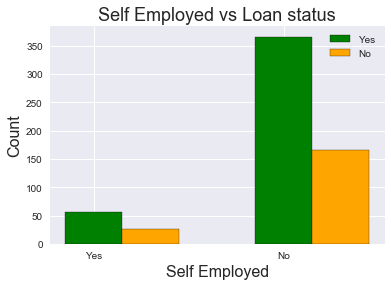

Relationship between Self-Employed vs Loan_Status

From the chart above, we can see that non self employed applicant were more approved for loan that the self employed applicant

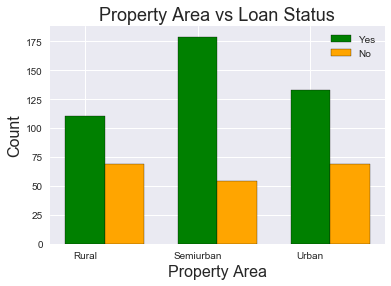

Relationship between Property area and loan status

From the chart above results we can infer that, the higher percentage of loan approval is for semi-urban houses followed by urban and rural houses.

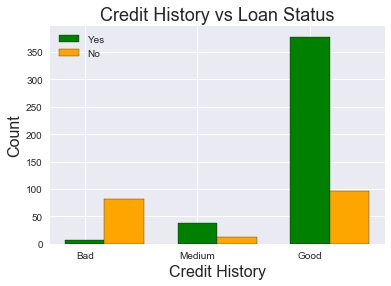

Relationship between Credit History and Loan Status

From the chart above results we can infer that, the higher percentage of loan approval is for customers with good credit history followed bycustomers with medium credit history and then the bad

Conclusion

From the analysis and visualizations above we can conclude that a customer that is;

- Married

- A Graduate

- Not self employed -Has good credit history

- With no dependents

- Reside in semi urban area

has an higher chances of been eligible for loan.

HERE is the link to the code